Two of the most important metrics for SaaS teams to track are customer churn rate and customer retention rate.

These are the product analytics that let you know if you’re onboarding your most aligned customers, if your product is delivering a high-quality experience, if the features you’ve gone live with are the right ones, and so much more.

Let’s take a deep dive into these key metrics.

Churn Rate vs Retention Rate

Churn rate and retention rate measure different customer data points.

Churn rate is the percentage of customers that leave within a given amount of time. Whereas retention rate is the percentage of customers that stay with you.

To put it simply, a high churn rate is bad because it means you’re losing churned customers, and a high retention rate is good because it means you’re keeping customers and increasing your repeat purchase rate.

There are three major benefits to having a high customer retention rate and a low customer churn rate.

First, you’re likely spending money on new customer acquisition costs.

If you spend $100 on ads for your customer acquisition cost to generate one customer who pays you $50 per month, you need that customer to stay with you for at least 2 months to break even and 3 months to make a profit.

If the customer leaves after month one you’ve just lost $50 in revenue.

Second, a low net churn rate and high customer retention rate indicate a high level of customer satisfaction and overall customer success.

It means you’ve identified a need in the market and you’re successfully filling it.

Now it’s just up to you to keep innovating so you keep more of your existing customers and don’t lose your edge over any potential competitors that enter the market.

Third, having a high customer retention rate allows you to accurately predict your future revenue.

This is important when it comes time to invest in expanding your team, increasing your ad budget, and enhancing your features or product suite.

A strong customer retention rate will help you feel confident that revenue will keep flowing in as you make these investments into the future of your company.

This would increase your odds of maintaining a strong net revenue retention rate, as well as a net dollar retention rate — both of which are key indicators of customer success.

For all of these reasons, you need to be tracking your churn rate and retention rate, knowing these numbers like the back of your hand.

It may sound obvious, but your retention rate is your most important customer retention metric.

Metrics You Should Track to Determine Churn and Retention Rate

When getting ready to prepare a churn and retention rate report, you’re going to want to have the following retention metrics ready:

- Total number of new customers onboarded in the last month

- Total number of new customers onboarded in the last year

- Total number of new customers who cancel after the first month

- Total number of new customers who cancel after the first year

- Average number of months a customer remains a customer before canceling

If you lock your customers into annual contracts, as is common in the enterprise SaaS world, don’t worry about tracking how many customers cancel before the end of the first month.

However, if you offer a free month trial for your SaaS business before locking a customer into an annual contract, you should account for how many cancel before the trial is over to determine your SaaS churn rate.

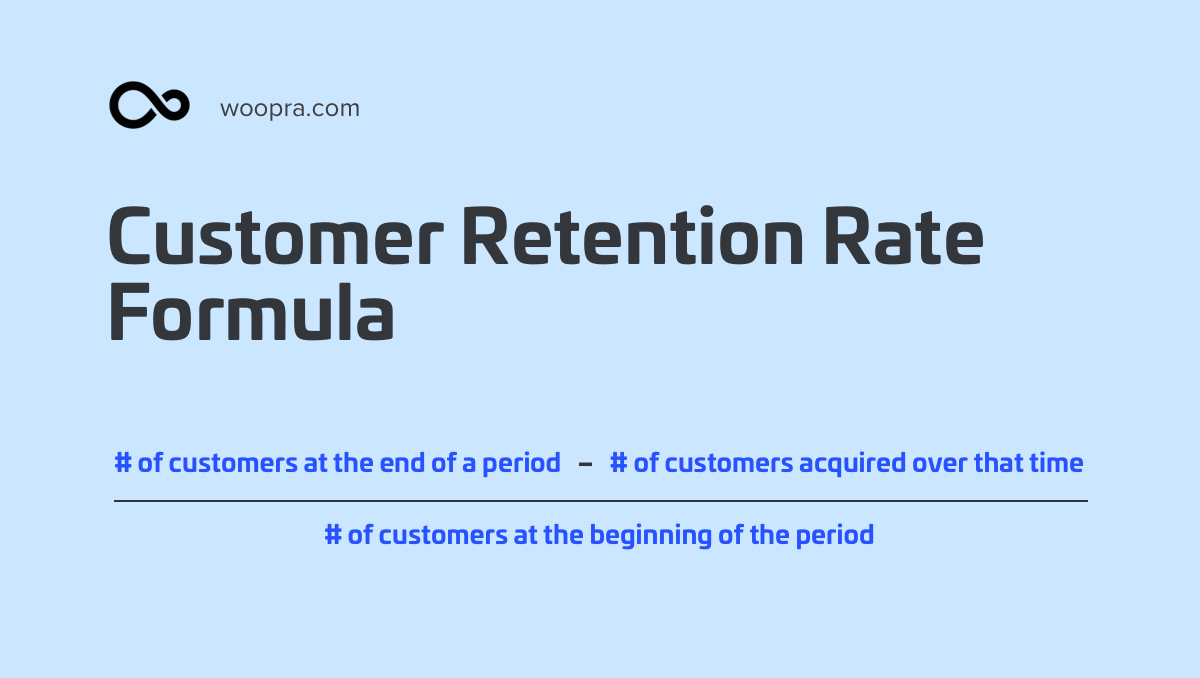

Retention Rate Formula and How to Calculate It

Calculating your customer retention rate, also sometimes referred to as renewal rate, is easy.

First, you want to determine the time period you’re looking at.

If you offer your services on a month-to-month basis, it would make sense to look at both a monthly retention rate as well as your overall annual retention rate.

If you only offer services on an annual basis then you’ll just look at your annual retention rate.

To calculate your customer retention rate you’ll just want to determine what percentage of your customer base keeps their account for the given period of time you’re looking at.

For example, let’s say in May you brought in 1,000 new customers and 50 of them canceled their accounts before the end of the month, which means you retained 950 customers.

950 is 95% of 1,000, which means your monthly customer retention rate is 95% for May.

What is a Good Retention Rate?

If you’re wondering what a good customer retention rate is, you can start by looking at industry averages.

The average monthly churn rate for SaaS companies is 3-8% which would mean the average retention rate should be in the 92-97% range.

Additionally, we know that average annual churn is 32-50% which means the average customer retention rate should be in the 50-68% range.

That being said, it’s best not to compare yourself against the industry average for retaining customers.

Optimize for Conversion & ROAS Now! Explore Woopra in a demo and enjoy a 2-week free trial: https://www.woopra.com/demo

Churn Rate Formula and How to Calculate It

There are two types of customer churn rates you’ll want to look at: voluntary churn and involuntary churn.

Voluntary churn is the number of people who unsubscribe for reasons of their own, such as they are unhappy with the product/customer service or no longer need it.

Involuntary churn refers to the number of people who are unsubscribed due to things like payment failure.

At the end of the day, a churned customer is a lost customer, and you want to do everything you can to prevent it from happening while laying the groundwork for greater customer success.

That all starts with understanding how many customers you’re losing — a.k.a. what your overall churn rate is.

The simplest way to calculate your customer churn rate is to use the basic churn calculation of:

Number of customers who left / total number of customers x 100

For example, if you had 1,000 new customers in a given time period and 50 of them left without renewing their subscription after customer acquisition, you would have a churn rate of 5%. Because 50 divided by 1,000 is 0.05; multiply that by 100 and you get 5%.

Just like user retention rate, you’ll want to calculate your churn rate on a monthly, quarterly, and/or annual basis depending on how long your subscription agreements last.

When calculating your customer churn rate, you’ll likely want to look at not just the percentage of churn but the monthly recurring revenue (MRR) or annual recurring revenue (ARR) lost due to churn.

This is considered your revenue churn.

This will help you get a better understanding of just how much net revenue churn is impacting your bottom line, and why even a “low” percentage like 5% could mean losing thousands of dollars each month.

Let’s say you sell a monthly subscription that costs $100 per month.

If you onboard 1,000 new customers each month, you’re bringing in $100,000 in MRR. If 50 of those 1,000 new customers don’t renew at the end of the month, your revenue churn rate is 5% like we previously discussed.

Five percent is a low percentage, that sounds great. It means you’re retaining 95% of your customers!

However, losing 50 customers at $100 revenue per customer means you’re losing $5,000 in monthly recurring revenue each month.

You may be thinking at this point, “$5,000 isn’t so bad if I’m retaining $95,000 heading into the second month.”

This is why even a 5% churn rate is something to work hard at improving. If you can move the needle 1-2% you’re potentially keeping thousands of dollars.

This is exactly why it’s important not to get complacent, even when your churn rate percentage looks good.

What's a Good Churn Rate?

The average monthly churn rate for a Saas company is 3-8%, and the average annual churn rate is 32-50%.

If you don’t want to lose out on revenue it’s so important to make your product the very best it can be, as well as be serious about providing stellar customer service.

Also, be consistent with asking for customer feedback. Survey them after a month of use, and gauge how they feel in terms of customer satisfaction.

Then, send another survey after a few months and see if the response is still as positive. You may also want to look at your Net Promoter Score for a firm quantitative assessment of customer satisfaction.

If you know you get a lot of churn at one particular point in the customer journey (for example, if you see a lot of churn in month 2) then you’ll want to figure out why and get in-depth insights into this aspect of customer behavior.

Use feedback surveys, reach out to customers directly, and find out what’s going on so you can fix it and create a better customer experience.

Also, remember to always be innovating. You could have a great retention rate and churn rate one day and then a competitor disrupts the market and suddenly everyone is leaving your company for the new one.

While you can’t always anticipate a truly disruptive competitor, you can put customer loyalty programs in place to try and retain loyal customers if a shiny new competitor comes into the space.

A strong customer loyalty program can help reduce churn and increase customer retention.

This could be something as simple as having a strong and personal account services team or sending customers quarterly gifts.

Remember that investing in keeping your existing customers is just as important as signing new customers.

How Do You Stack Up?

Now that you know how to calculate your churn rate vs retention rate at their most basic levels - how do you stack up?

Are you currently sitting within or above the industry averages?

What plan can you and your analytics manager come up with to be more data-driven and increase your retention rate and reduce your churn rate?

Here’s a hint: you do both at the same time by staying focused on customer satisfaction, offering excellent customer service, and actively seeking to retain the highest total number of existing customers.

There are always dials to turn to increase your retention rate and reduce your churn rate to increase customer lifetime value. For more reading, check out these 5 analytics books for a deeper dive.